The newest Charles Schwab Business brings a full set of broker, banking and you can monetary advisory features using their operating subsidiaries. None Schwab nor the items and functions it has can be joined on your jurisdiction. None Schwab nor the products and characteristics it’s can be registered in almost any most other jurisdiction. The banking subsidiary, Charles Schwab Financial, SSB (affiliate FDIC and you may an equal Homes Financial), will bring deposit and you will credit items. Access to Electronic Services may be restricted otherwise not available during the symptoms from top demand, business volatility, systems update, repair, or for other grounds. Commission-100 percent free trade identifies 0 earnings energized to your deals folks indexed joined securities placed within the Us Locations Typical Exchange Occasions within the thinking-brought broker membership given by Public Investing.

When you promote a protection, you should submit their defense for the brokerage no afterwards than just a couple of working days following the product sales. Including, for individuals who ended up selling offers out of a stock to your Friday, the order create choose Thursday. Among the many is actually counterparty risk – the potential for the other people’s default through to the fulfillment or expiration from a binding agreement. Additionally, the lack of transparency and you will weaker exchangeability prior to the newest formal exchanges is also result in devastating incidents during the an economic crisis. The flexibleness away from derivative contracts structure is also become worse the situation. The greater complicated style of the brand new bonds will make it more difficult to help you dictate the reasonable worth.

Agreements are designed using outlined, mission requirements based on generally acknowledged financing concept; they may not be based on your circumstances otherwise chance profile. You’re accountable for establishing and you can keeping allocations certainly property within their Package. Agreements involve continuing investment, no matter what market criteria. Find our very own Investment Arrangements www.rbxechange.com Fine print and Sponsored Posts and Conflicts of interest Revelation. All of the investments encompass the risk of losses and the earlier overall performance out of a safety otherwise an economic tool does not make sure upcoming results otherwise efficiency. When the lender failed, the new counterparties to help you the purchases had been kept met with industry requirements instead hedges and may perhaps not, consequently, fulfill the personal debt to their other counterparties.

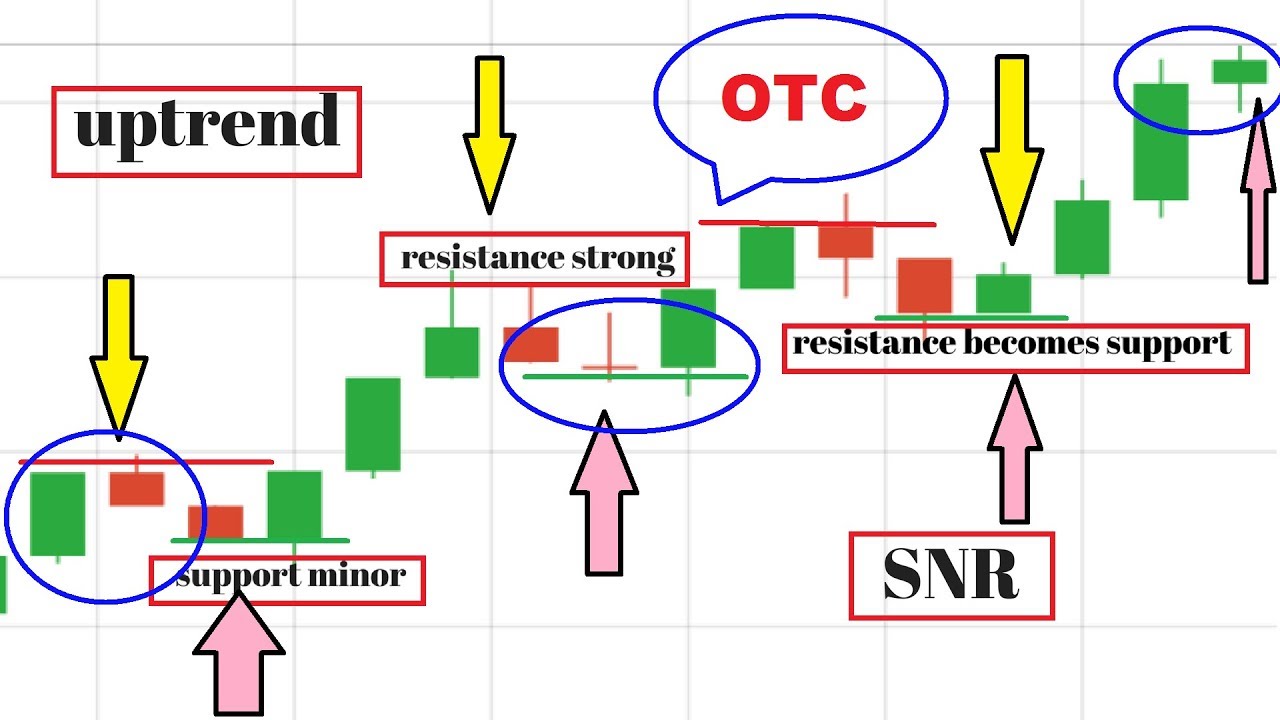

People using OTC trade can obtain stock inside the overseas organizations by to purchase Western Depository Invoices (ADRs). These are bank-granted certificates symbolizing shares inside the a different business. A western standard bank can purchase offers in the business on the a different change, then sell ADRs to help you You.S. buyers. As the label implies, OTC means the fresh change is made individually anywhere between a couple of people and you will without needing an intermediary, like the NYSE. The way it functions is the fact both parties acknowledge a cost of the brand new monetary assets they want to trading and you can transfer those people assets ranging from by themselves. Since the change is carried out myself involving the traders and the investors, the values and you can degrees of the fresh exchanged financial property try private to them.

An enthusiastic OTC market entails several companies that suffice since the market creator, such OTC Places Category otherwise FINRA. More information regarding your broker can be obtained by clicking right here. Social Paying is actually an entirely-possessed subsidiary of Social Holdings, Inc. (“Personal Holdings”). This is not a deal, solicitation away from a deal, otherwise suggestions to purchase otherwise promote bonds otherwise open a brokerage membership in every legislation in which Societal Investing isn’t inserted. Ties issues given by Personal Paying commonly FDIC insured. Apex Clearing Firm, the cleaning firm, has extra insurance in excess of the typical SIPC constraints.

What exactly is OTC Exchange inside Crypto?

Thus, a chain response happened, impacting counterparties then off the Lehman OTC change. Many of the inspired additional and you will tertiary counterparties didn’t come with lead negotiations to the financial, the streaming feeling in the new feel hurt them as the really. That is one of the leading reasons one triggered the brand new severity of your own drama, and this ended up resulting in prevalent damage to the global savings. Since the consumers and you may seller package personally together for OTC alternatives, they’re able to set the blend from struck and you may expiration to meet the individual demands.

The fresh OTC marketplace is an option to have short businesses or those individuals that do not want to help you checklist or do not number to your fundamental exchanges. List to the a fundamental exchange are a costly and you may time-consuming techniques and you can outside the economic potential of a lot smaller companies. Businesses may realize that listing from the OTC market brings immediate access to help you funding from sale from shares.

OTC (Over-the-Counter) Places and Bonds

Thus, the risk of speculation and you can unanticipated occurrences can also be harm the soundness of your own locations. Freeriding abuses are present when you buy a protection inside a money account one lacks adequate compensated money and promote the same shelter before depositing fund to pay for their buy. So it solution can happen whether the purchase and you may sales exist on the a comparable date otherwise to your some other days. When organizations do not be considered in order to checklist to the a simple business exchange including the NYSE, the securities might be traded OTC but can remain topic to some controls by the Ties and Replace Payment. Mortgage-supported securities or any other types such as CDOs and you will CMOs, which have been replaced solely from the OTC places, could not cost dependably because the exchangeability totally dried-up in the its lack of consumers.

FINRA ran an OTC exchange referred to as OTC Bulletin Panel (OTCBB), but FINRA theoretically stopped surgery of your own OTCBB to your Late. 8, 2021. Of many otherwise all of the issues appeared here are from our lovers which make up united states. So it influences which things we write about and you may in which and exactly how the product seems to the a page.

For each individual must review a good investment technique for their otherwise her very own form of state prior to one financing choice. Payment scratches the official import away from ties to your customer’s account and cash to your seller’s account. American Depositary Receipts (ADRs), sometimes entitled ADSs or lender licenses you to show a specified count out of shares out of a different inventory. There is the possibility that there might possibly be con during the very reduced number of the newest red piece industry,” he states. “The major tier of the OTC market is rather safe and chances are decent. The requirements is actually you will find enough identified regarding the a family that’s probably not also risky,” he says.

OTC deals try bilateral, and each people you are going to face borrowing risk inquiries out of the counterparty. Clearing is the process of reconciling requests and you may sales of numerous choices, futures, or ties, and also the head transfer of funds from you to definitely financial establishment to a different. The procedure validates the availability of the correct money, details the new import, as well as in the situation out of bonds guarantees the fresh beginning of one’s protection to your client. Non-cleaned positions can cause settlement risk, and when deals do not clear accounting mistakes tend to occur where a real income is going to be forgotten. In terms of a good margin mortgage, you will want to regulate how the application of margin matches your own financing values.

The newest preferred OTC instrument to possess was released inside the past several years. Most of the time the new ICO design lets investors to help with its favourite plans and you may found tokens in person as opposed to tight oversight out of bodies. Companies have raised large numbers away from funding within just a number of days undertaking the opportunity to drive your panels desires give. However, we’ll give specific options for the newest very-called “little seafood” on the following part. The brand new crypto areas is developing, and you may big and small professionals exactly the same are looking for a knowledgeable ways to get in it.

An overhead-the-avoid market is not centralized and you can takes place anywhere between a couple functions, for example a swap that takes place ranging from two individuals who get market a percentage from a friends that isn’t indexed for the an exchange. An above-the-stop market can consist of any shelter, for example equities, products, and you will derivatives. A profile director owns in the 100,one hundred thousand shares from a stock you to definitely deals to your more-the-prevent field. The newest PM establishes it is the right time to sell the security and you will instructs the new investors to obtain the marketplace for the newest inventory. Just after getting in touch with about three market makers, the newest people go back which have bad news.

Form of OTC tiers

Inside old-fashioned locations, a lot more Us businesses’ offers change OTC (from the 10,000) than just on the Nasdaq and you may NYSE shared. The fresh by-product OTC areas alone account for 600+ trillion inside notional really worth each year. Exchanges for instance the Ny Stock exchange or a good crypto-comparable such Poloniex basically try to be mediators between people and you will suppliers. Investors post rates he is happy to sell possessions to own (asks) while some article prices he’s prepared to buy assets for (bids).

It does not require people SEC control or economic reporting, and you can includes many layer businesses. There are many well-recognized communities to own OTC trade, which can be line of in terms of the bonds they give traders. The key advantageous asset of OTC trade ‘s the number of bonds available on the new OTC business.

Post-trading handling allows the buyer and you can supplier away from securities in order to sources out and you may fix this type of errors. As well as matching the facts of your purchase and sell orders, post-exchange processing has progressing info from control and you will authorizing commission. All phrases from advice are subject to transform with no warning inside reaction to moving on business requirements. Analysis contains here out of third party business are extracted from just what are thought legitimate provide. Yet not, their reliability, completeness otherwise reliability cannot be protected.

What is Blog post-Change Processing?

The promotion depends on the new information on for each deal and will also be previewed for you just before distribution for every exchange. So it rebate will be subtracted from the prices to put the fresh trading and will also be shown on your own trade verification. To find out more, see the Commission Schedule, Buy Move Rebate FAQ, and you can Order Circulate Rebate Program Words & Conditions. Certain types of ties are generally exchanged OTC, unlike thanks to an official exchange.

We’re also likely to capture a deep diving for the OTC as it identifies crypto to see just what potential the brand new digital currency places is actually setting up to own an alternative family of trader. If you would like discover more about crypto OTC desks, check out this Flippening podcast of Nomics Crypto, that can aided inform this article. Pursuant in order to a keen SEC consult, FINRA features agreed to make advertised brief product sales exchange analysis publicly offered. Participants one report transactions in the OTC Collateral Ties and you will Minimal Collateral Bonds to the ORF need to conform to the new 6600 and you will 7300 Collection, in addition to some other applicable regulations. However, the newest ORF usually hold the admission and you can dissemination from last product sales analysis to the such as bonds. PwC is the All of us affiliate company otherwise certainly its subsidiaries otherwise associates, and may possibly make reference to the fresh PwC system.

The newest OTC Segments Classification has qualifications criteria you to bonds have to satisfy when they want to be noted on its program, just like protection transfers. For instance, as listed on the Better Market and/or Strategy Business, enterprises must provide particular financial suggestions, and disclosures should be newest. The advantage of having fun with a crypto OTC desk to find and sell huge amounts away from cryptocurrencies try to stop rates slippage. When selecting a good number of cryptocurrency, you’d must pick quicker bits from certain personal suppliers alternatively than almost everything at once. Rates slippage happens when you get buying the past pieces of one’s chose cryptocurrency in the a higher price compared to brand-new market value you ordered a couple of chunks that have. It’s most likely best if you pay attention to rates noted to your a cryptocurrency replace such Binance to locate a great ballpark when to make a trade.

If you hold the ties in the an electronic style with your broker-specialist, their agent-broker often provide the bonds on your behalf eventually earlier underneath the the newest code. You will want to speak to your representative-agent from the one alter which can particularly apply at you or the membership. The newest SEC cautions that in the event that you hold an actual, report securities certification, you may want to deliver they for the representative-broker before to fulfill the fresh quicker payment cycle. Yet not, it’s all the more rare to own buyers to hang report bonds permits. Get a better understanding of just what OTC segments and you can ties is actually, as well as factors to own adding him or her into your trade otherwise paying method.

Extremely economic advisors imagine exchange within the OTC shares since the a speculative carrying out. The brand new spending information given in this post is actually for educational intentions simply. NerdWallet, Inc. cannot render advisory otherwise broker services, nor can it highly recommend otherwise recommend buyers to shop for otherwise sell kind of brings, securities or any other investment. Alternatives purchases usually are advanced, and you will people can be easily lose the complete amount of the funding or even more in the a short span of energy.